Nowadays, there are fewer and fewer tax-attractive destinations in Europe, and few can boast of offering good conditions for both individuals and legal entities.

For example, Monaco has an excellent tax framework for individuals, who are exempt from all income tax, but in exchange it has a considerable corporate tax (up to 25%, a figure comparable to that of France and Spain).

Andorra, on the other hand, remains one of the few European countries that not only allows individuals to preserve their assets, but also offers a very favourable tax environment for entrepreneurship.

In today’s guide we will explain in detail the characteristics of corporate tax in Andorra and other taxes related to business activity.

Which companies have to pay taxes in Andorra?

A company is considered Andorran, and therefore subjected to Andorran Corporate Tax, if it meets the following criteria:

- It is incorporated in accordance with Andorran legislation.

- It has its registered office in the Principality of Andorra; or

- The company has its effective management headquarters located in the Principality.

Effective management means that the managers carry out their work from Andorra or that at least the board meetings take place in the Principality.

As we will see later, the option of incorporating a company in the Principality but managing it from another country can cause problems.

What is the Andorra corporate tax rate?

Andorran Corporate Tax taxes companies on their profits (income minus expenses) at a rate of 10%.

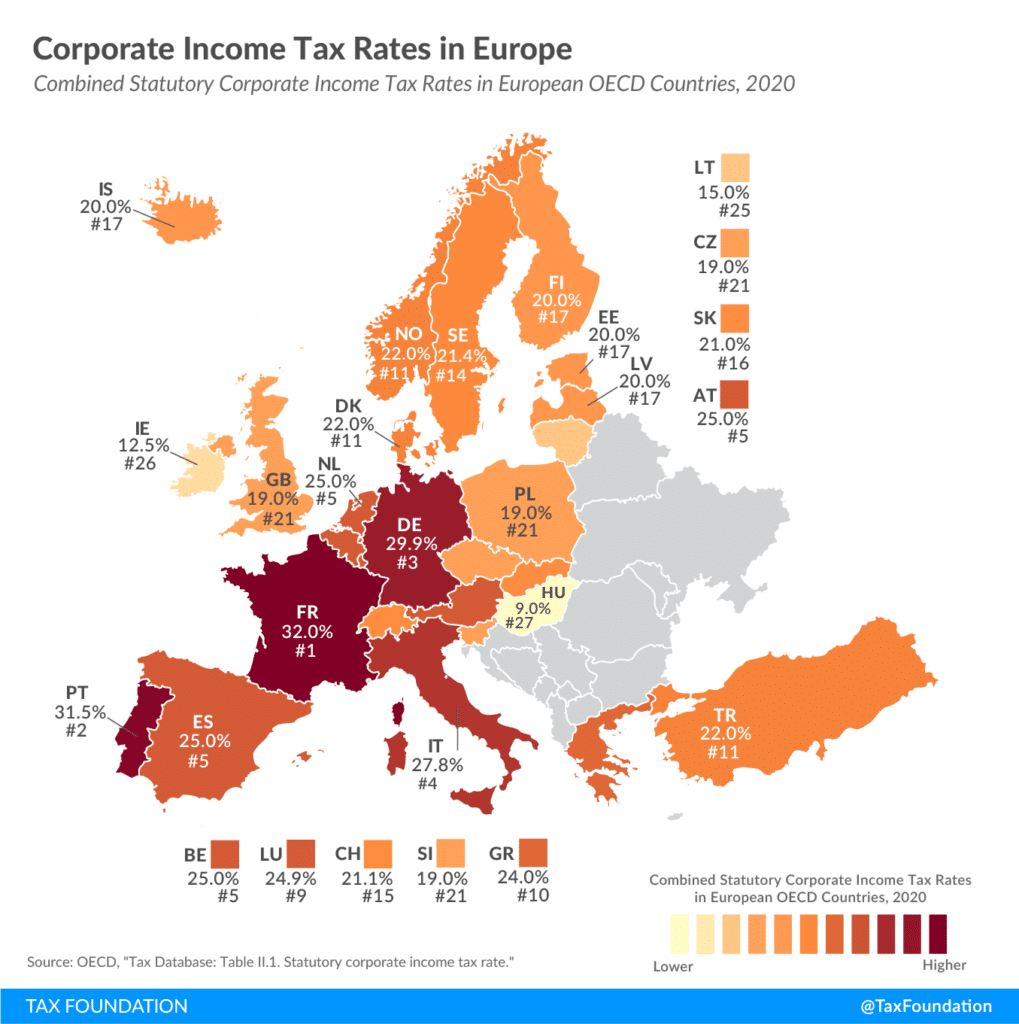

Therefore, we are talking about one of the lowest corporate tax rates in Europe, well below that of its neighboring countries (in France the rate is 32% and in Spain it is 25%).

Other advantages

Andorran Corporate Tax also has many other advantages, such as the following:

- Negative taxable bases, after the relevant adjustments, can be carried forward for up to 10 years.

- There is no limitation on the deductibility of financial expenses.

- There is a participation exemption that allows dividends or capital gains received from subsidiaries to be exempt from tax.

- Dividends distributed to resident shareholders are not taxed.

- Dividends distributed to non-resident shareholders are not subject to withholding tax.

Other business taxes

Let’s also look at other taxes relevant to business activity.

Dividends taxes

Dividends in Andorra are taxed differently depending on whether they come from local or foreign companies.

For dividends from Andorran companies, the system is extremely attractive: if you are a tax resident of Andorra, dividends received from a local company are entirely exempt from personal income tax, they are subject to a 0% tax rate.

Similarly, non-residents receiving dividends from Andorran companies do not face any withholding tax, which again results in a 0% effective tax rate (in Andorra, another matter is what their country of tax residence charges)

This non-taxation of dividends from your own company is a huge advantage, as it frees you from a very common problem in other countries: the double taxation of paying first for corporate tax and then for receiving dividends.

Making a quick comparison with neighboring Spain:

| Spain | Andorra | |

| IS | 25% | 10% |

| Dividends | 19% to 30% | 0% |

| Total | from 39.25% onwards | 10% |

As you can see, it is not just that taxes are higher in Spain, it is that double taxation quickly causes a compounding effect that ends up consuming almost half of your profits before they reach you as an individual.

Dividends from foreign sources

The situation changes when dividends originate from foreign companies: in this case, an Andorran tax resident is generally subject to a 10% tax on the foreign dividends.

However, this taxation also depends heavily on whether there is a Double Taxation Treaty (DTT) in place with the country from which the dividends originate, because Andorra does not have a DTTs signed with large economies such as Germany, Italy, the United Kingdom, the United States, China, India, Japan or Russia.

In these cases, domestic laws in those countries set a higher withholding tax rate that can range from 15% to 35%. A practical example is the U.S.: by default, the United States withholds 30% on dividend payments to non-resident aliens from countries without a treaty. Therefore, if an Andorran tax resident receives USD 1,000 in dividends from an American company like Apple, USD 300 is withheld at the source.

Capital gains taxes

The tax conditions for capital gains are equally or more attractive than those for dividends.: individuals are generally taxed at 10% on capital gains, with an exemption for the first €3,000 of gains.

However, when it comes to capital gains on the sale of shares, there are additional exemptions that can reduce the effective rate significantly, sometimes even to 0%.

Specifically:

- If you own 25% or less of the company, any profit from selling those shares is completely exempt from capital gains tax.

- If you own more than 25% of the company, you will pay up to 10% on the gain, unless you have held the shares for more than 10 years. After 10 years, the gain is fully exempt from tax.

In simple terms, selling shares in which your stake is 25% or lower incurs no capital gains tax. If your ownership exceeds 25%, the standard 10% rate applies unless you have held the shares for over 10 years, in which case the gain becomes tax-free.

Practical examples

Imagine you are an Andorran tax resident and hold some publicly traded American shares (such as Apple or Tesla). Since your stake in these companies is well below 25%, you would generally pay no capital gains tax on the sale.

On the other hand, if you sold 100% of your Andorran company (assuming you own more than 25% of it), you would face a tax rate of up to 10% on the capital gain. However, if you had owned that company for more than 10 years, the gain would be completely exempt from tax.

Income tax

For your salary as an administrator or for the salaries of your employees, the conditions of the Andorran income tax are also very advantageous, since in the Andorran IRPF there are only three brackets:

| Up to 24.000€ | 0% |

| From 24.000€ to 40.000€ | 5% |

| from 40.000€ | 10% |

In practice, this means that your effective income tax rate is always less than 10%. For example, if you earned €120,000 per year, you would only pay €8,800, a mere 7.33% average rate.

To make accurate estimates you can use our Andorra tax calculator.

Tax optimization strategies

Considering that there are some initial exempt sections in the 10% income tax, salaries never actually reach 10% tax, as we saw in the previous example of the €120,000 salary.

This means that a common strategy to reduce the amount owed for corporate tax is to assign a salary as an administrator, since the part that is taxed by income tax (for example, those €120,000 that are taxed at 7.33%) are deducted from the tax base and are no longer taxed by corporate tax.

However, there is another piece that complicates this puzzle: social contributions. In Andorra, social contributions are governed by somewhat complex rules, and the amount paid to the CASS (the Andorran social security) can quickly escalate.

For this reason, it is advisable that a professional analyze your situation and suggests the best strategy to minimize your tax contribution.

Can I incorporate a company in Andorra and live abroad?

Many users ask us to incorporate or create companies in Andorra to pay low taxes. However, many of them do not want to move to Andorra or establish offices or hire employees in Andorra.

Currently, the incorporation of offshore companies in Andorra without physical assets, human resources, or resident directors is not viable and is very risky for the following reasons:

- Their tax residency may be questioned by foreign tax authorities if the directors do not live in Andorra.

- International tax transparency rules or CFC rules target companies without economic substance or physical and human resources.

- Andorran companies require a commercial authorization, which usually implies having a space of at least 20 square meters (i.e. an office).

It is possible that some advisers might try to sell you a non-resident company, but keep in mind that they are doing so solely for their own benefit, and this could ultimately cause you serious problems.

A tax analysis of your particular circumstances is essential to incorporate a company in Andorra in accordance with current legal requirements.

Thinking about doing business from Andorra?

For the reasons mentioned above, an increasing number of companies, especially those trading in digital goods and services, are relocating to Andorra to take advantage of its taxation.

If you are interested in changing your tax residence to Andorra, we recommend reading the report “The Definitive Guide to Living in Andorra”, available for free at the end of this article.

And if you are considering incorporating a company in Andorra, we will be happy to help you.

You can contact us without obligation in the following ways:

- By sending an email to [email protected]

- Or by filling out the form below:

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.