Written by Marc Cantavella, AndorraInc Co-Founder & Andorran Tax Expert

Questions? Ask Marc on Whatsapp

Andorra is one of the countries with the most attractive direct taxation in the Eurozone, so it is not surprising that more and more entrepreneurs decide to move their companies to our small principality.

This is an ideal location for setting up a company, especially for those who carry out an online activity: in the last years at AndorraInc we have helped countless high-value remote workers, investors, influencers, creators of infoproducts, online marketers, digital entrepreneurs such as SAAS owners… to establish themselves in the Principality.

In this article we will explain everything you need to know about setting up your company in Andorra

New report

The report “The definitive guide to living in Andorra” is now available, with detailed information on Andorra’s tax framework, residence and society.

Click here to download it for free.

Why should you set up a company in Andorra?

It is worth remembering that Andorra is not part of the EU, and therefore not even EU citizens have the right to freely settle in the Principality. This is a migration restriction that makes sense, given the tiny size of the country (less than 90,000 inhabitants) since an open-door policy could quickly lead to saturation.

And the two main ways of entering the country are:

- Passive residency: the visa for retirees, who intend to live off passive income

- Active residency: the visa relevant to you, who wish to come to the country to work

Active residence is divided into “as employee” and “as self-employed”. The first is the case of the non-resident who gets residence permit thanks to a job offer from a local company.

And the second is the case that concerns us now: the non-resident entrepreneur who sets up a company in the Principality to carry out his business activity from here.

Benefits of doing business in Andorra

Setting up your company in Andorra can offer many advantages over its neighboring jurisdictions.

Among these, the following are worth mentioning:

- It has one of the lowest corporate taxes in the Euro zone, with a maximum rate of 10% (we will explain the tax framework in detail right now).

- The Foreign Investment Law allows non-residents to invest in Andorra.

- There is no audit law that obliges you to audit the company when it invoices a certain amount.

- The incorporation and maintenance costs are much lower than in Malta, Luxembourg or Cyprus.

- Very good internet connectivity across the whole country.

An unbeatable tax system

Let’s briefly review the advantageous tax conditions that the Principality offers both for companies and for individuals:

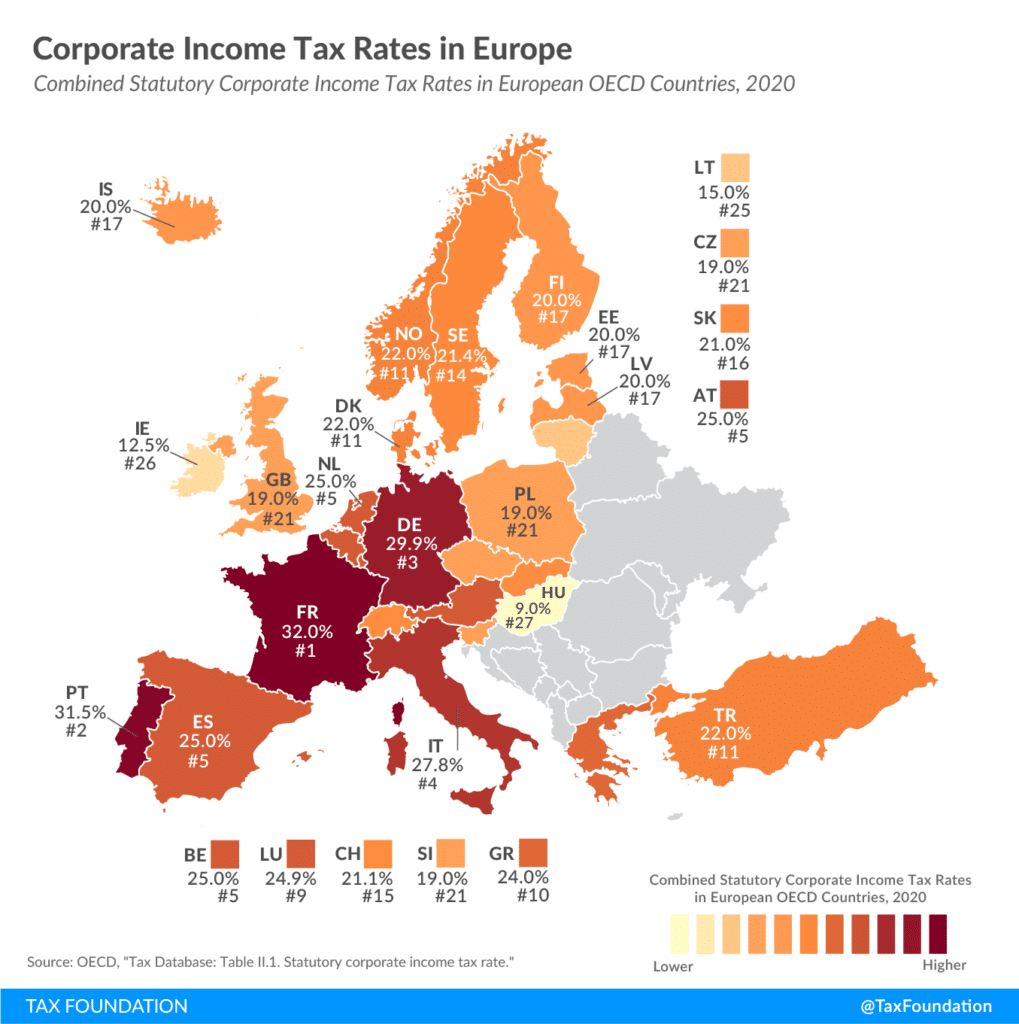

Corporate Tax Rate

Andorran corporate tax is imposed on companies on their profits (income minus expenses) at a rate of 10%.

This is one of the lowest corporate taxes in Europe, certainly much lower than in its neighbouring countries: in France it is 32% and in Spain 25%.

In addition, negative tax bases, after the relevant adjustments, can be applied during the following 10 years.

Dividend Taxes

If you are a tax resident in Andorra and you receive dividends from a company that is also based in Andorra, these dividends are subject to a 0% tax rate. This is remarkable specially in Europe, where almost every country impose double taxation of corporate profits: first through corporate tax, then through the distribution of dividends to shareholders.

If you, as Andorran resident, receive dividends from any non-resident company, those dividends are generally subject to a 10% tax rate, but it is true that withholding taxes may occur depending on the country, as explained in the guide to Andorran dividend taxes.

Capital Gain Taxes

If you, as Andorran resident, own 25% or less of a company and you decide to sell your shares, you pay no capital gains tax on the profits from the sale of those shares.

If you own more than 25% of the company, you would pay up to 10% on the gain, unless you held the shares for more than 10 years. After 10 years, the capital gain becomes tax-exempt.

For the selling of a real estate property there is a time-dependent tax bracket, where the shorter the holding period, the higher the tax:

- Up to 1 year: 15%

- More than 1 year up to 2 years: 13%

- More than 2 years up to 3 years: 10%

- More than 3 years: The tax rate decreases by 1% for each additional year of ownership.

- After 12 years: 0%

Personal Income Tax

For your salary as an administrator or for the salaries of your employees, the conditions of the Andorran income tax are also very advantageous, since in the Andorran IRPF there are only three brackets:

| Up to 24.000€ | 0% |

| From 24.000€ to 40.000€ | 5% |

| from 40.000€ | 10% |

In practice, this means that your effective income tax rate is always less than 10%. For example, if you earned €120,000 per year, you would only pay €8,800, a mere 7.33% average rate.

To make accurate estimates you can use our Andorra tax calculator.

Steps to incorporate a company

While there is the possibility to redomicile an existing company from another country, it is not usual: the normal process is that the client dissolves the company in its country of origin and creates a new one in Andorra.

Incorporating a company in Andorra seems simple but it is a process that involves a heavy workload and can take between two and four months, depending on the client’s profile. Generally, the slowest procedures tend to be the banking compliance and the commercial opening.

These are the steps:

Company name reservation

The interested party can propose to the Andorran government three names in order of preference. The latter will have 10 days to respond.

Application for foreign investment

This procedure must be carried out in the case of non-residents who wish to acquire more than 10%. A very complete dossier must be provided and this procedure can take up to one month and 15 days.

Opening of a bank account for the deposit of the share capital

One of the most complicated procedures is to pass the compliance of a bank for the company. For this you will have to explain the SOF (source of funds) and your activity.

If you belong to the world of cryptocurrencies, this step is usually cumbersome.

Constitution and registration of the company in the register

The articles of association are formalized before an Andorran notary in order to create the company in Andorra in an official manner and the company is registered in the Andorran commercial register.

Commercial opening

In the corresponding “comú” (town hall) of Andorra a license is obtained that allows to begin to operate and to invoice. This procedure nowadays is being quite costly given the generalized collapse of the Andorran “comuns”.

Application for the Tax Registration Number

The tax identification code is confirmed and the company is registered with the Andorran Social Security.

What documents are needed for the company formation?

Generally, setting up a company in Andorra involves gathering a lot of documentation. The administration and banks perform a due diligence and compliance function to avoid money laundering in the Principality.

Despite what many people think, setting up a company in Andorra complies with the highest standards of international transparency and is highly scrutinized to avoid money laundering.

In general, the documentation requested is as follows:

- Criminal records duly legalized with the Hague Apostille. They are usually valid for a maximum of three months from their issuance.

- Copy of your passport, legalized with the Hague Apostille.

- Documents explaining your work profile and business model (i.e. CV, business plan, etc.).

- Copy of your passport, legalized with the apostille of The Hague.

- Documents proving your tax compliance (previous tax returns) and the origin of your funds (accounting, annual accounts, etc.).

Costs of active residence

Active residence on a self-employed basis involves some fairly low administrative and notary fees, the fee for the law firm that handles both the residence application and the incorporation of the company, and above all the deposit with the AFA.

The AFA is the Andorran Financial Authority, and each individual who enters the country via active residence on a self-employed basis must leave a deposit of €50,000 with this institution. This deposit was originally €15,000, but due to the boom in arrivals to the country it has been raised to filter by purchasing power.

It is an unpaid deposit, and it will be returned to you when you undo your active residence, either because you leave the country or because you have obtained another type of visa.

Who should incorporate a company in the Principality?

Andorra is very attractive for certain profiles whose core professional interests are not anchored to any specific country: influencers, youtubers, athletes, consultants, digital marketing experts, programmers, professional gamblers, lawyers, financiers, investors and crypto-investors….

In all these cases (except perhaps liberal professions such as engineers and doctors), the incorporation of the company is an indispensable requirement to obtain the active residence, to be able to invoice and therefore to benefit from the beneficial Andorran tax conditions.

Can I incorporate a company without living in the country?

Yes, it is entirely possible to set up a company in Andorra without living in Andorra. No law prevents you from doing so.

However, concepts such as the effective address or the economic substance (where the office is located, the workers…) are very important when determining the tax residence of a company.

Even if a company has been incorporated in Andorra, it must be taken into account that the tax administration of the country of origin can consider that the company is also resident in that country if it can prove that the effective management of the company is carried out there.

For example, no matter how much a company is incorporated in Andorra, if another country proves that it is managed from there, it will have to pay the Corporate Tax of that country.

How to take the first step?

If you are seriously interested in changing your tax residence, we recommend reading the report “The definitive guide to living in Andorra”, with the most complete information on Andorran taxation, residence and company.

And if you want professional help, do not hesitate to contact us. At AndorraInc we guarantee the maximum rigor for the transfer of tax residence.

You can contact us without obligation in the following ways:

- By sending an email to [email protected]

- Or by filling out the form below:

Sources

- https://www.e-tramits.ad/tramits/ca/sollicitud-dautoritzacio-dinversio-estrangera-directa-constitucio-trasllat-internacional-obertura-sucursal/p/ied-cto

- https://www.ccis.ad/wp-content/uploads/2017/01/llei-inversio-estrangera.pdf

- https://www.e-tramits.ad/tramits/ca/impostos/is

- https://www.govern.ad/documents/1898932/3741655/Paying_Taxes_Andorra_Eng_300720.pdf

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.

All communications are encrypted and will be treated with absolute confidentiality. Your data will never be shared with third parties.